Blog

What are the Key Considerations When Adopting Generative AI in Capital Markets?

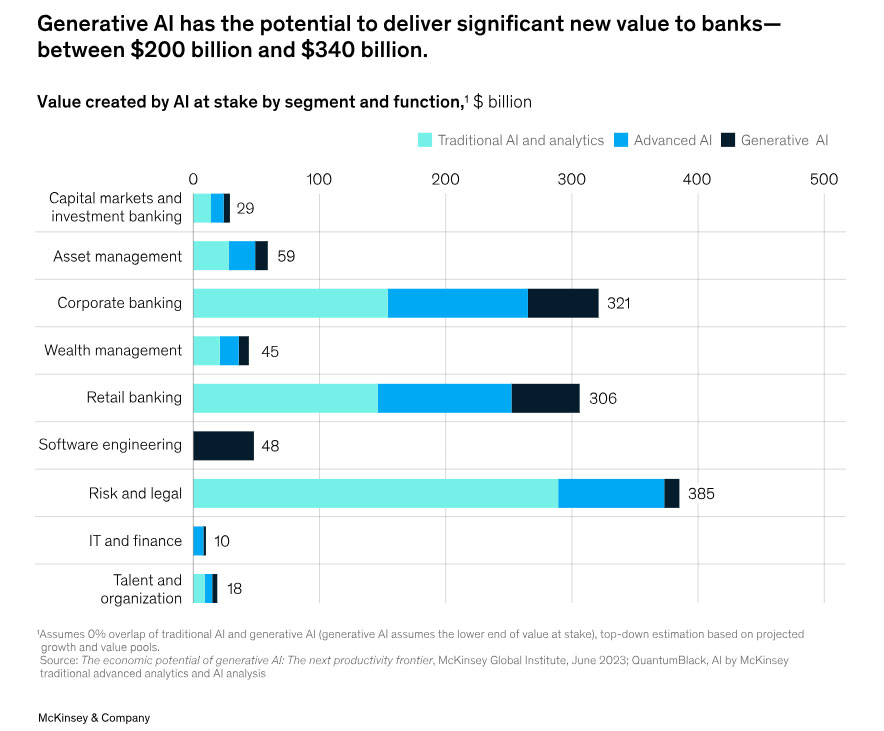

The financial landscape is on the brink of a profound evolution, driven by the revolutionary capabilities of Generative AI (Generative Artificial Intelligence). By generating entirely new data points that surpass traditional analysis, this cutting-edge technology holds the promise of reshaping capital markets as we know them. According to a McKinsey study, the integration of AI could potentially contribute an additional $13 trillion to the global economic output by 2030, resulting in an annual GDP growth of 1.2% worldwide. However, realizing its full potential in these markets necessitates a comprehensive understanding of its multifaceted implications.

Considerations for Embracing Generative AI in Capital Markets

Emerging technologies like Generative AI have the potential to revolutionize the financial sector, and the strategic integration of these innovations is crucial for firms seeking to enhance their competitiveness and efficiency in the ever-evolving capital markets landscape. Below are the critical considerations for embracing Generative AI in capital markets:

1. Strategic Implementation: Capital markets encompass a broad spectrum of activities, from trading to asset management. Enterprises must identify the areas where Generative AI can provide maximum value. This could include algorithmic trading, risk management, or customer service. Furthermore, leaders must weigh the potential benefits against the associated risks, such as execution complexity and scalability. A meticulous analysis will guide the adoption of Generative AI in the most impactful and efficient manner.

2. Productivity Enhancement: Generative AI has the potential to revolutionize the operational dynamics of capital market firms by streamlining workflows and reducing the reliance on manual tasks. By automating mundane and repetitive activities, such as data analysis and document processing, firms can allocate their resources more effectively towards strategic and value-driven tasks, like analyzing market trends, developing innovative investment strategies, or enhancing client relationships. Leveraging Generative AI for productivity gains can lead to a more efficient and competitive firm.

3. Risk Management: The outputs generated by Generative AI models may occasionally lack reliability or be influenced by biases. This presents a unique set of risks that must be managed meticulously. Firms must continuously assess the accuracy of the outputs and ensure their alignment with real-world data. Moreover, they must consider the potential for "hallucinated" responses lacking grounding in reality. Firms must revamp their risk frameworks and governance structures to mitigate these risks. This may involve implementing new validation processes or establishing guidelines for the best use of Generative AI.

4. Stakeholder Trust: Earning the trust of stakeholders is imperative for the successful adoption of Generative AI. This encompasses employees, clients, partners, and regulators. To achieve this, firms must exhibit the credibility of the AI outputs and the ethical principles governing their usage. This might entail transparency regarding the limitations of Generative AI and how it complements human decision-making. Additionally, firms should communicate the benefits of Generative AI clearly and compellingly, emphasizing its potential to enhance productivity, efficiency, and innovation.

5. Integration with Existing Systems and Technologies: Generative AI constitutes only one facet of a firm's comprehensive digital infrastructure. It is crucial to ascertain how it fits within the existing systems, applications, tools, and technologies. This encompasses digital transformation initiatives, cloud migration strategies, and data and analytics operations. Integration with other emerging technologies, such as quantum computing, can further amplify the capabilities of Generative AI. However, this necessitates meticulous planning and coordination to ensure compatibility and optimize performance. Furthermore, firms must contemplate how to distribute hardware resources and computational loads across diverse technologies and applications.

6. Monitoring Advancement: As Generative AI becomes more prevalent, firms must continually monitor developments in the field. This encompasses staying abreast of new research, techniques, and applications. However, as more firms adopt Generative AI, using it to gain a competitive edge may become less effective. Firms must be mindful of this and adapt their strategies accordingly. This might entail exploring novel use cases or concentrating on areas where Generative AI can provide unique value. Ultimately, staying informed and adaptable will be pivotal to maintaining a competitive position in the market.

7. Engagement with Regulators: As regulators delineate new guidelines for applying Generative AI, firms must engage proactively with them. This necessitates shaping new policies concerning data privacy, copyrights, and intellectual property issues. Firms must also contemplate how to responsibly employ client and market data while ensuring compliance with these regulations. This proactive approach can aid firms in evading potential legal and reputational risks associated with Generative AI implementation. By collaborating closely with regulators, firms can ensure that Generative AI is leveraged to benefit both the firm and its stakeholders.

Conclusion

In the pursuit to drive digital transformation , its is important for the CXOs not to fall in the Technology Trap. Adopting Generative AI in capital markets is a complicated process that demands proper evaluation of numerous factors. These include strategic implementation, productivity enhancement, risk management, stakeholder trust, integration with existing systems and technologies, monitoring advancements, and engagement with regulators. By addressing these considerations thoughtfully and strategically, firms can utilize the full potential of Generative AI, driving positive change and competitive advantage in the dynamic world of capital markets.

Intelliswift specializes in developing innovative solutions tailored to the banking and financial sectors, ensuring organizations adapt to the fast-paced digital landscape. By integrating cutting-edge technology, Intelliswift simplifies operational processes, enhances security, and strengthens compliance measures. Our services are tailored to assist financial institutions in overcoming specific challenges. These include providing trading platforms, risk management systems, and data analytics tools. With an emphasis on scalability, reliability, and continuous support, Intelliswift empowers businesses to function more effectively and acquire a competitive edge within the ever-evolving financial landscape.

Contact us to learn more about the transformative potential of Generative AI and how it can propel your firm to new heights in the competitive world of capital markets.

Sreejith Chandran, VP, BFSI

Sreejith is the Vice President and head of the BFSI business portfolio at Intelliswift. He is vital in managing customer relationships, revenue and PnL growth, delivery, fostering partner collaborations, and strengthening our expertise in banking, capital markets, and insurance solutions.